Key points

- Self-pay or paying cash for healthcare services can often be cheaper than using insurance.

- High-deductible health plans have led to patients paying more out-of-pocket at insurance-negotiated rates which can be higher than cash rates.

- Self-pay can be beneficial for services like blood tests, outpatient procedures, and diagnostic assessments, especially if the insurance deductible hasn't been met.

- Self-pay also allows patients to choose from a wider range of providers and negotiate better deals.

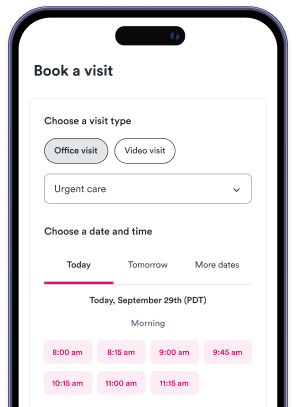

- Patients can ask their provider about cash prices at any time and should be clear and direct in their approach. Websites like Solv can help patients find self-pay prices ahead of time.

Americans hold a few core beliefs about how health insurance is supposed to work. They know that it’s meant to protect them. They’ve been told that if they can afford to get health insurance, they should. And they’ve been taught that — more times than not — being insured will save them money on medical procedures.

After all, this makes logical sense: insured patients won’t be responsible for paying a full medical bill out of pocket, whether that’s for routine check-ups, surprise emergency room visits, or big-ticket surgeries. Insurance should help patients avoid facing massive debt or a huge unexpected bill.

Insurers have more power than one person, and can use that to negotiate bigger deals with hospitals and providers. Ideally, insurance companies negotiate the best possible rates for patients and cover the majority of the balance if anything is left over (after all, that is their job!). But research shows that an increasing number of medical services — from routine blood work to MRIs — often are cheaper for patients when they pay cash and avoid using insurance altogether. Oftentimes, cash pay prices are significantly cheaper than a negotiated price. In light of this trend, according to Consumer Reports, a growing number of healthcare providers and treatment centers are offering discounts for “self-pay” — using cash to pay for certain medical services — even when patients are covered by insurance. Experts say patients should weigh the pros and cons of this approach, and that it’s not a silver bullet for every scenario. But we’ll explore why, how, and when self-pay can benefit patients and families and how Solv can help.

Behind the rise of self-pay

Over the last decade, there’s been an uptick in high-deductible health plans, known as HDHP (a deductible is considered high if it’s at least $1400 for an individual and $2,800 for a family, according to Healthcare.gov). More than 30 percent of workers enrolled in employer-provided health insurance had a high deductible plan in 2020 — a jump from 24% in 2015, according to the Kaiser Family Foundation.

These plans reflect that employers have been shifting a greater share of rising healthcare costs to employees. These high-deductible plans mean that insured patients end up paying for a greater portion of services out of their own wallets. However, in these situations, patients pay at the price points their insurer negotiated — rather than rates set for people without insurance — until they reach that threshold and insurance kicks in. This price point is often much higher than the self-pay cash rate.

But patients have the power to take a different path, according to Consumer Reports. They can research and shop around to see what the same medical services cost in cash to evaluate their best options. New websites and companies have cropped up that are dedicated to helping patients compare cash prices, while Solv also offers services to help. Self-paying patients can also create win-win scenarios for providers, who can offer discounts to patients paying in cash because cutting out the middleman — insurance companies — lowers their administrative and billing costs.

After all, a buyer knows the price of nearly all other services and goods before agreeing to purchase them — except in healthcare. Viewed another way: would you commit to buying a new car or house without seeing the price tag?

How do cash prices help people who have insurance?

Using self-pay doesn’t mean that patients should stop paying for — or using — insurance full stop. Going through insurance is often the best bet for pricey care, like extensive surgeries or procedures. But there are specific situations where cash prices might be cheaper, making it important to weigh the pros and cons depending on a family’s medical needs, according to Consumer Reports.

When is self-pay the right move? Cash payment typically is useful in situations when:

- You have a high deductible plan and are looking for care, haven’t reached your deductible yet and don’t expect to hit the threshold within the calendar year (before the deductible resets for the following year). Note: amounts paid via self pay are not typically applied to your deductible and you should ask your health plan if you have questions.

- You need services like blood tests, regular outpatient procedures, imaging, and diagnostic assessments, such as lab panels or MRIs

Insured patients can also check cash prices to help negotiate a better deal with providers. A new law that took effect this year requires hospitals to publish their prices (though data shows that many large hospital systems aren’t complying, according to The New York Times). People can check their insurance company’s website or call to get a quote (but keep in mind that patients may have to cover copays and coinsurance, in addition).

Then, patients can ask their provider what their cash discounts are in order to do a side-by-side comparison. They shouldn’t hesitate to push a provider on the best rate they can offer.

And for circumstances when patients opt for self-pay, they should remember that the world is now their oyster! They don’t have to stick to in-network providers and have freedom to explore a wider suite of options. After all, every provider accepts cash, according to MarketWatch, which can make cash prices more competitive.

This is because with self-pay, a provider has to consider what an individual patient can afford to pay out of pocket — rather than consider what a large corporate insurance company can afford, which is higher. Providers then have to price services accordingly in order to stay competitive, according to MarketWatch. If one provider is far costlier than another, the patient can simply take their business elsewhere.

How does the self-pay process work?

There’s a lot to keep track of when considering self-pay. We help break down the self-pay process one step at a time.

- Assess the situation. What kind of medical care do you need? Is this a routine or big-ticket item? What month of the year is it, and how close are you to hitting your deductible?

- Do your research and shop around to compare prices. First, you should try to figure out how much the procedure costs in-network. You can use an insurer’s online tools or call the company (keeping in mind that final costs fluctuate, and may not exactly match the quote). Costs often vary widely by provider and region of the country, so this step is extra important.

- Directly ask providers what their cash prices are. Some providers may not make it easy to find estimated prices, so be persistent and remember that you’re entitled to this information: as of 2021, hospitals are required to provide patients with the cash price information during a visit even if the patient has insurance.

- If the insurer’s cost is higher, ask providers for a cash discount. You may be surprised at how many providers will do this when they ask. That’s key: patients often have to pose the question, according to KTVB. However, some providers committed to transparency make this information easily accessible upfront, or advertise discounts widely. Other hospitals feature price estimate calculators on their websites.

- If you decide to go with cash prices out of network, compare local competitors. Once patients aren’t limited to providers in-network, they can choose between a wider range of doctors.

Tips on how to ask your provider about pricing

When to pop the question: There’s no perfect time to ask about cash prices — and luckily, you have many opportunities to start this conversation. If there’s an expected procedure coming up, patients can call their provider and ask an administrator about cash discounts in advance. If a patient is in an appointment and it becomes clear on the fly that more care will be needed, they can ask right then. Whenever possible, you should also ask for billing codes for the service, according to KTVB. That way, you can more easily compare prices for the service with competitors’ rates.

How to pose it: Aim to be clear and direct. Ask outright: ‘What is the cash price for this service?’ If they push back or seem confused, keep going and ask someone else, according to Consumer Reports. Once patients are armed with information and know what else is out there, they can directly ask providers for a better deal. This can be effective at standalone imaging centers, for example, or surgery centers that need to stay competitive, according to Kiplinger.

Where can patients find self-pay prices ahead of time? Solv can help. Solv’s ClearPrice initiative details the prices that patients can expect to pay for COVID testing, flu shots, chest x-rays and more. Learn more here.

FAQs

What is self-pay in healthcare?

Self-pay in healthcare refers to paying for medical services out-of-pocket, in cash, instead of using health insurance.

When can self-pay be beneficial?

Self-pay can be beneficial for routine services like blood tests and diagnostic assessments, especially if you have a high-deductible health plan and haven't met your deductible for the year.

Can self-pay be cheaper than using insurance?

Yes, in many cases, self-pay or cash prices can be significantly cheaper than the rates negotiated by insurance companies.

Can I use self-pay even if I have insurance?

Yes, you can choose to use self-pay for certain services even if you have insurance. It's important to compare the costs and benefits in each case.

How can I find out the cash price for a medical service?

You can ask your healthcare provider directly for their cash prices. Some providers may also list their prices online. Websites and services like Solv can also help you compare cash prices.

How can patients ask their provider about cash pricing?

Patients can ask their provider about cash pricing at any time. They can call in advance of a procedure or ask during an appointment. The key is to be clear and direct, asking outright, "What is the cash price for this service?"

How does self-pay affect the choice of healthcare providers?

With self-pay, patients are not limited to in-network providers and can explore a wider suite of options. Since every provider accepts cash, this can make cash prices more competitive. Providers have to consider what an individual patient can afford to pay out of pocket and price their services accordingly to stay competitive.

Where can patients find self-pay prices ahead of time?

Patients can find self-pay prices ahead of time on platforms like Solv. Solv’s ClearPrice initiative details the prices that patients can expect to pay for various services, helping them make informed decisions about whether to opt for self-pay or use their insurance.