Key points

- Oscar, a healthcare engineer, received a surprise $6,000 medical bill after an emergency room visit.

- Despite his background in healthcare, Oscar struggled to understand and contest the charges due to lack of transparency.

- Oscar's story highlights the complexities and pitfalls of the American healthcare system, including unclear pricing, high deductibles, and billing errors.

- Oscar's experience underscores the need for transparent healthcare pricing to allow patients to make informed decisions about their care.

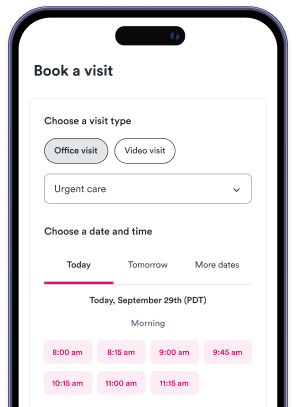

- Solv's ClearPrice initiative is mentioned, aiming to demystify healthcare pricing. Solv offers a ClearPrice calculator to find the cost of care in specific zip codes and a quiz to determine if one should ask for the ClearPrice of care in advance.

As part of Solv’s ClearPriceTM initiative, our team is highlighting real-life stories about how surprise medical bills have affected people’s lives.

Oscar's Story

Oscar stared at his computer screen, refreshing his online insurance portal yet again for what felt like the hundredth time that day. He’d been awaiting a medical bill for a trip to the emergency room a month earlier, his anxiety building each day.

“[I] was just kind of waiting for the bill, because I knew it was going to come,” said Oscar, who works in healthcare engineering and lives in San Francisco. “I didn't know how much it was going to be, but I knew I wasn't going to like it.”

In December, Oscar had started experiencing an alarming set of symptoms: shortness of breath, an elevated heart rate, and persistent tightness in his chest. He took at-home COVID tests to rule out the virus. After a few days without improvement, he grew increasingly nervous and booked the soonest urgent care appointment he could find.

When Oscar arrived at urgent care, an EKG and chest x-ray were performed. His x-ray came back normal but the providers noted his EKG looked irregular, so they sent him to an emergency room in the city that was operated by the same company for additional testing.

Oscar knew this was going to cost him. He had a high-deductible insurance plan through his employer, meaning that he paid fully out of pocket for medical care until he hit his deductible of roughly $1,500. With a professional background in healthcare and hospital systems, Oscar felt like he knew more than the average person about the complexities of billing. He always tried his best to avoid pitfalls — but in this case, he needed help immediately and didn’t have time to shop around.

At the ER, Oscar was treated by a doctor who wanted to perform another chest x-ray. He explained that he’d gotten one hours earlier — but the doctor still wanted to perform another one; Oscar resisted, asking if the hospital could call their partner urgent care clinic to get the reading on the previous study.

The doctor refused, according to Oscar, saying that he didn’t trust the other provider’s reading and wanted to see it with his own eyes. “I’m in the freaking emergency room at this point,” said Oscar. “I’m freaking out.” He asked the doctor what the second x-ray would cost, at the very least, explaining that he had a high deductible plan and didn’t want to be charged twice. But the doctor said he didn’t have the information and wouldn’t budge, according to Oscar.

Eventually, Oscar relented and got the second x-ray. The discrepancy on his original EKG was cleared up: the second doctor found that the readings now looked normal and that Oscar was safe to return home. But the resistance that Oscar had experienced when pushing for clear information upfront about the cost of his care had only begun to build — and would turn into a process that dragged on for months.

When Oscar finally saw that bill that he was waiting on appear in his portal one month later, he was stunned: $6,000.

He tried to make sense of these numbers. It appeared that the total cost had come out to roughly $7,000, but his insurance company contract brought the fee down to around $6,000. Because this would exceed his plan’s out-of-pocket maximum, Oscar would owe about $3,000 and his insurer would cover the rest.

But Oscar knew that hospitals miscoded bills all the time. “I went to go in and look at the itemized bill because I wanted to know what services they charged for,” he said. The documentation didn’t include line items for each service. “They just did a sloppy job and didn't break it down,” he said.

This kicked off an exasperating three-month-long game of hot potato, in which Oscar was passed from person to person in his attempt to get his bill itemized to verify the charges before paying it off. “I was trying to be my best informed healthcare consumer here, from everything I've learned, and advocate for myself,” he said. He called the hospital’s billing department every day for a week, he said, and finally got through. This was to little avail: after verifying his identity, the representative said they couldn’t send the itemized bill for security purposes.

Frustrated, Oscar pressed further. He was told that they had to mail him a blank request form to fill out — email was not possible, they said — which he could send back. Only then could they send the itemized bill (pending approval, that is). After submitting his form, Oscar waited for about six weeks. His apprehension grew as he worried about the unpaid bill being sent to collections and harming his credit score as time stretched on.

In early April, Oscar finally received the itemized bill he’d been chasing. He spent a few hours deciphering billing codes, cross-checking them on the internet. “There’s no easy database of all these codes that explains what they are in human language,” he said.

To escalate the saga, shortly thereafter, Oscar received a call from a billing department asking if he wanted to pay his unpaid bill. He let them know that he might want to contest the insurance claim and asked to be connected with the right point of contact, but was met with radio silence. Then the voice on the other line said they couldn’t help.

Oscar turned to his colleagues, who have legal and medical backgrounds, to help him figure out his next steps. After seeking advice, Oscar now plans to write a letter to the billing department explicitly describing the chain of events and proposing an alternate payment.

He knows that he’s far more fortunate than most Americans who don’t have the means, time or luxury to take time off work, or consult with colleagues with knowledge of the system. “I do this with background knowledge on the healthcare system,” he said, yet “still I’m completely in the dark.”

If Oscar ultimately can’t fight the bill down, it will make a dent on his savings — but he is one of the lucky few who won’t be plunged into debt due to a medical bill.

To Oscar, this experience has reinforced that the healthcare insurance market in America is broken — and that there’s an urgent need for transparent pricing that is accessible to the public. “Every time I have tried to be an informed consumer, and make price-informed decisions, it’s like the system's rigged against me,” Oscar said.

“[Insurance companies] have free rein to target everyone, because they know that they have a captive audience,” he said. “It’s so important to actually have true, visible prices.”

It’s clear to him the status quo must change. “No market on Earth functions without consumers knowing what they're going to pay for a service… it's completely untenable,” he said. “If I'm going to buy a car, I know what the car is going to cost. And the problem with healthcare is that you don't have a choice when you need it.”

Actual user story. All pricing details are reported by the individual. Names may have been changed to protect anonymity. If you’d like to share your experience dealing with a surprise medical bill, write to us at [email protected] to tell us your story.

Five tips for choosing to self-pay for healthcare

Oscar's not alone in his frustration and confusion around our healthcare system, of course. When considering self-pay, there is a lot to keep track of. Here's a quick break down the self-pay process one step at a time.

- Assess the situation. What kind of medical care do you need? Is this a routine or big-ticket item? What month of the year is it, and how close are you to hitting your deductible?

- Do your research and shop around to compare prices. First, you should try to figure out how much the procedure costs in-network. You can use an insurer’s online tools or call the company (keeping in mind that final costs fluctuate, and may not exactly match the quote). Costs often vary widely by provider and region of the country, so this step is extra important.

- Directly ask providers what their cash prices are. Some providers may not make it easy to find estimated prices, so be persistent and remember that you’re entitled to this information: as of 2021, hospitals are required to provide patients with the cash price information during a visit even if the patient has insurance.

- If the insurer’s cost is higher, ask providers for a cash discount. You may be surprised at how many providers will do this when they ask. That’s key: patients often have to pose the question, according to KTVB. However, some providers committed to transparency make this information easily accessible upfront, or advertise discounts widely. Other hospitals feature price estimate calculators on their websites.

- If you decide to go with cash prices out of network, compare local competitors. Once patients aren’t limited to providers in-network, they can choose between a wider range of doctors.

Learn more about Solv’s commitment to cracking open the mystery of healthcare pricing through our Solv ClearPrice Pledge. Try our Solv ClearPrice calculator to find the cost of care for services in your zip code, or take the quiz to find out if you should be asking for the ClearPrice of care in advance of care.

FAQs

Why did Oscar receive a $6,000 medical bill?

Oscar received a $6,000 medical bill after a visit to the emergency room due to an irregular EKG reading and a second chest x-ray.

Did Oscar's insurance cover the entire bill?

No, Oscar's insurance covered part of the bill. He had a high-deductible plan and had to pay about $3,000 out of pocket.

Why did Oscar struggle to understand his bill?

The hospital did not provide an itemized bill, and Oscar had to spend hours deciphering billing codes and cross-checking them on the internet.

What does Oscar's story reveal about the American healthcare system?

Oscar's story highlights the lack of transparency in healthcare pricing, the complexity of medical bills, and the challenges patients face in contesting charges.

What is Oscar's perspective on the healthcare insurance market in America?

Oscar believes that the healthcare insurance market in America is broken and that there is an urgent need for transparent pricing that is accessible to the public.

What is the Solv ClearPrice calculator?

The Solv ClearPrice calculator is a tool provided by Solv as part of their ClearPrice initiative. It allows users to find the cost of care for services in their zip code, helping to bring transparency to healthcare pricing.

How can patients find out the cash price for a procedure?

Patients can find out the cash price for a procedure by directly asking providers. As of 2021, hospitals are required to provide patients with the cash price information during a visit, even if the patient has insurance.

How can patients potentially get a discount on their healthcare costs?

Patients may be able to get a discount on their healthcare costs by asking providers for a cash discount. This is particularly relevant if the insurer's cost is higher than the cash price. However, it's important to note that patients often have to pose the question, as not all providers readily offer this information.